7 Ways To Build A Mini-Emergency Fund. Now!

If you save me today, I’ll save you tomorrow. – Money (Unknown)

I remember being three years old and waking up in the middle of the night to seek shelter in my parents’ bathtub. I had no clue what was going on at that age, but I remember vividly the aftermath when hide and go seek in the bathtub was over. Hurricane Hugo had made landfall in South Carolina, almost 4 hours away, and made its way to Lincolnton, North Carolina. Right now, I’m 35 years old and I can still feel think back on how it felt that day. Fast forwarding, despite that scary experience, in the same month of 2015, I was led to move to Wilmington, North Carolina on the east coast about an hour and a half from Myrtle Beach. I never really stressed about hurricane season, I was more excited than I would be living at the beach. There were so many times as a single mother, I tried to save up money, just to get take my boys to experience a weekend there, and well now, we’re literally a 16-minute drive from the shoreline. In 2016, my fiancee and I left apartment living and purchased our first home. It was shortly after we were married, that I got my first taste of the hurricane season in Wilmington, North Carolina. Hurricane Matthew hit the Carolinas on October 8-9, 2016. I remember being on the second story of our home if our loft bedroom, terrified and gazing out of the window while Jerry slept and told me to relax. See, he had lived in Wilmington for over a decade after graduating college, and he was very familiar and comfortable with going through these storms. I, on the other hand, was borderline livid that he could just lay there and sleep while my heart pounded out of my chest. After the storm was over, the flooding went back down and life moved on as usual.

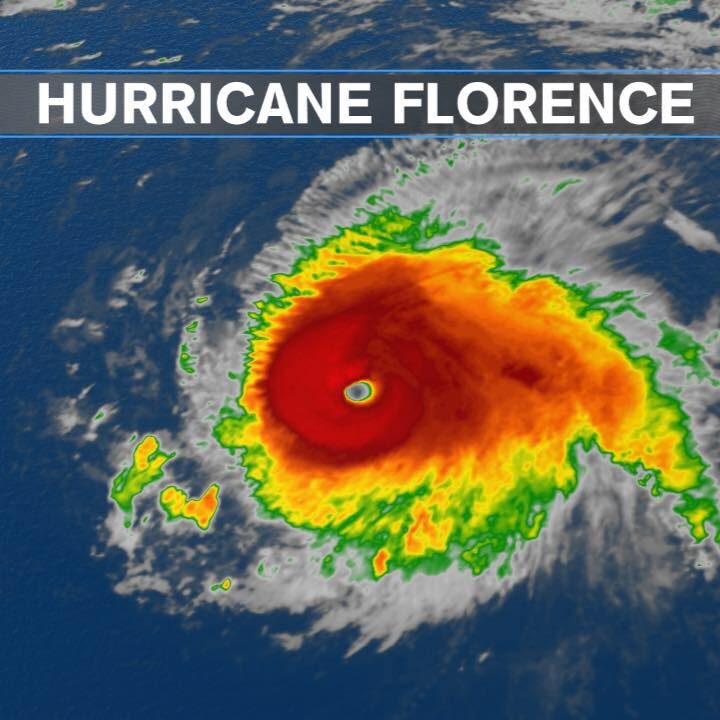

Then, in 2017, we were blessed and fortunate to upgrade from our starter home and moved closer to the beach. Again, I didn’t think about hurricane season. On August 31, 2018, a category 4 hurricane by the name of Florence formed, and alerts started flowing in our city. I began witnessing store shelves wipe out, family members back home started begging me to come home, Jerry started to prepare, and then voluntary evacuations started. You guessed it, I was a wreck. 19 days of playing double dutch with a possible life or death situation. 2 weeks and 5 days to prepare for it to shift and miss us, or hit us and destroy us.

This experience taught me the vital importance of an emergency fund and the need there is to teach the financial importance of both a mini & true emergency fund. If you’re wondering we stayed or we left, we buckled down, prayed, and yes stayed. Jerry kept reassuring me that we would be fine, and I trusted God and his decision. Now we did lose our huge pecan tree in the backyard, the stump is still alive and growing, but to God be the glory it landed inches beside the house and not on it while our children were sleeping in the back wing of the house. As we drove around looking for some restaurant that was open a few days after power was restored, shoutout to Chris’s restaurant, we drove around a deserted city. We saw flooding, destroyed homes, and a lot of damage. We could have left, but I am glad we didn’t. I got to witness the aftermath of being unprepared for life’s emergencies, even if it is out of your control.

I was working at Whole Foods Market at the time, and so many employees and managers left the city and ended up stranded due to roads, highways, and interstates being flooded out. We even had issues with their trucks arriving to restock shelves at one point. It was during this time that we saw the regulars of that store stop coming in, and then all walks of life started to come seeking a hot meal. We saw people barefoot, had to talk politely to people who were irate because they couldn’t afford items, and so much more but I’ll just leave it there. I took all this in and made a commitment that not only would my family be able to be prepared, but that I would be an advocate of financial literacy for others as well.

My hope is, that if you made it this far in this article you’ll prepare yourself for life’s emergencies, even if you’re not preparing for a hurricane. This article will focus only on a Mini-Emergency fund, but I’ll be back next week on how to start building a true emergency fund.

7 Ways To Build A Mini Emergency Fund. Now!

First Things First – Eliminate Your Latte Factor

Your latte thing is that spending habit you have every pay period that you truly could do without. Starbucks, frequent nail salon trips to change polish, fast food, let’s just say nightlife, I think you get the drift. Take some time and print out your bank statement, and YES KINGS AND QUEENS GRAB A HIGHLIGHTER and start studying your spending. Highlight the expenses you can do without, then start adding them up. Once you get that number, commit to putting that amount into your Mini Emergency fund instead.

Start Taking Budgeting More Seriously

I have to admit, this word makes me cringe sometimes, but it’s necessary. Whether you like to do it by hand, or if you would rather use a Fin-tech solution to make it easier to access, it must be a part of your monthly financial regimen. Until you figure out where your money is going and how frequently it is going there, you’ll never be at a place where you can start to see what can be put away.

Eliminate Debt Fast

Before you swipe, tap, or insert that credit card, you must have a committed and disciplined plan to pay it back. Most debt comes from impulsive and emotional decisions, so if you can’t afford it twice, you most likely don’t need it. Before you get the loan, have a plan of how quickly you intend to pay it back and have a solid plan of how you’re going to spend your funding. A lot of times, a debt consolidation option can help you pay off debt so that you can be free of a huge monthly payout, and give you room for a fresh start with cashflow management. With debt payoff, especially in the economy, we’re living in today, you’ll need more income. So that leads up right up to the next one, find an opportunity to make more money.

Make More Money

Finding a way to secure another bag is a perfect way to solve all of your financial issues. I’m not talking about a second job. You should have the residual income to help you take care of all the linear money you have flowing out of your bank accounts each month. I am currently helping 7 people who want to get their financial house in order ( only 4 more slots left, by the way) to create a firm financial foundation and help them earn an additional income. Making money from my smartphone changed my life 7 years ago before I pulled up in Wilmington, North Carolina. Homeless, no car, a Boost mobile phone, and one of those Virgin mobile prepaid hotspot boxes, whew chile, thank you Fintech for making our lives so much easier. But seriously, if you’re reading this, and you totally get how important finances are for everyone, then you can make some serious income by sharing what you learn and apply from working directly with me, but I digress.

Tithe

Galatians 6:7 states 7 Do not be deceived: God cannot be mocked. A man reaps what he sows.

God gives us 7 blessings of tithings in Malachi 3:10, and I encourage you to take some time and read it yourself. But yes, tithing. Put it in your budget, treat it like a bill, pay it on time like a credit card, and be cheerful as you give. I will never forget knowing the power of tithing and being homeless, still going to church, and not having a dime to pay. God knew my desire to give and he started providing so that I could give. But listen, when I started giving, the windows of heaven definitely opened up for me. I can’t explain to you how quickly things started changing and what steps ordered me to be where I am today. So much I still can’t reveal, but God keeps his promises. Just try it! Let me know how it goes!

Get Educated & Build Better Credit

There is nothing more powerful than getting educated about finances, how to build your personal & business credit correctly, how to help your family make better financial decisions, and how to leave a legacy by prioritizing financial freedom. I’m going to give you a freebie right now, click this link and get a FREE WEALTH guide that will help you get started to shift your mindset so you can truly start building these emergency funds.

Automate Savings, But Don’t Oversave

Just like the IRS! Right now you’re like, what? When you get your paycheck, the IRS has already taken theirs, right? Well, make sure you get yours first. Call HR, login into your portal, and automate that a portion of your paycheck goes right to savings. If you can’t touch it, you can’t spend it. Make sure that your savings account is not easily accessible. You don’t want to be tempted to borrow from your savings, because newsflash, you probably won’t put it back. This is exactly why you don’t want to over-save for your mini emergency fund either. Why? Once you give over 4 figures, and I could even say 5K, you’re going to want to dip in that account, because most likely you’ll think you’ve got enough for the account to not miss it. You can even choose a savings account open that helps build your credit too! NO SIR, NO MAAM. Save it for a rainy day or one of life’s emergencies.

Okay, that’s it. It’s 10:43 PM, and I cut this one close. Almost felt like I was rushing to the credit card website to pay the day of a bill before midnight, lol. Autopay for us all, that’s the goal!

Don’t forget to subscribe, book a session, and be on the lookout for the next #FinancialFreedomFriday email, we’re going to take it up a notch and talk about building a TRUE EMERGENCY FUND.